Drive Revenue Growth with Optimized Trade Investments

Learn how strategic resource allocation, performance measurement, and collaboration can help your business effectively drive trade investments in revenue growth.

-

How can businesses optimize Trade Investment to drive Revenue Growth Management effectively?

-

What is the role of a Trade Investment Framework in developing a successful Revenue Growth Management strategy?

-

How can AI and analytics improve Trade Investment decisions for Revenue Growth Management?

-

What are the key factors when developing a Trade Investment Framework for maximizing Revenue Growth?

-

What are the best practices for managing Trade Investment risks while pursuing Revenue Growth Management objectives?

-

Develop an Impactful Trade Investment Framework with MathCo.

-

Overview

-

Solution Methodology

-

Our Expertise

How can businesses optimize Trade Investment to drive Revenue Growth Management effectively?

Optimizing trade investment is crucial for businesses seeking sustainable revenue growth. By focusing on the following areas, businesses can effectively drive revenue growth management:

- Resource allocation: Allocate resources strategically to high-impact trade investments, ensuring maximum return on investment (ROI).

- Performance measurement: Establish clear KPIs and metrics to evaluate trade investment effectiveness and make data-driven decisions.

- Collaboration: Foster strong relationships with trading partners to create mutually beneficial opportunities and unlock revenue growth potential.

- Continuous improvement: Regularly review and refine trade investment strategies based on market dynamics and changing business objectives.

What is the role of a Trade Investment Framework in developing a successful Revenue Growth Management strategy?

A trade investment framework plays a critical role in developing a successful revenue growth management strategy by:

- Offering a structured approach to identify and prioritize trade investment opportunities.

- Establishing guidelines for evaluating and managing trade investment risks.

- Facilitating data-driven decision-making by leveraging AI and analytics for insights and predictions.

- Ensuring alignment between trade investment goals and overall business objectives, fostering long-term revenue growth.

How can AI and analytics improve Trade Investment decisions for Revenue Growth Management?

- Identifying profitable trade investment opportunities through predictive analytics and data-driven insights.

- Evaluating and quantifying trade investment risks, allowing businesses to make informed decisions.

- Optimizing resource allocation by identifying high-impact investments with the greatest potential for revenue growth.

- Providing real-time performance monitoring enables businesses to adjust strategies as market conditions change.

What are the key factors when developing a Trade Investment Framework for maximizing Revenue Growth?

- Business objectives: Align trade investment goals with overall business objectives to ensure a cohesive strategy.

- Market dynamics: Understand market trends and competitor activities to inform trade investment decisions.

- Trading partner relationships: Assess the strength and reliability of trading partners to minimize risks and maximize opportunities.

- Risk management: Establish a robust risk management process to identify, assess, and mitigate trade investment risks.

What are the best practices for managing Trade Investment risks while pursuing Revenue Growth Management objectives?

- Diversification: Diversify trade investments across various partners, industries, and markets to mitigate risks.

- Comprehensive due diligence: Conduct thorough due diligence on trading partners to minimize potential risks.

- Risk assessment and mitigation: Regularly assess and monitor trade investment risks, implementing mitigation strategies as needed.

- Flexibility and adaptability: Remain agile and adaptable to respond to changing market conditions and emerging risks.

Develop an Impactful Trade Investment Framework with MathCo.

Overview

Our team of experts specializes in helping businesses optimize customer and category plans and rolling out these plans to customers seamlessly. We understand the importance of revenue growth management and provide tailor-made solutions to meet the unique needs of our clients. We use the latest AI and analytics technology advancements to provide data-driven insights that help businesses stay ahead of the competition. Our solutions are based on a deep understanding of the industry landscape, which we continuously update by analyzing top competitors in the industry.

Solution Methodology

- Develop post-event analytics that uses the historical performance tracker to evaluate the results of previous promotions.

- Employ predictive analytics for real-time consumer-oriented data to target the appropriate customers with suitable offers at the right time.

- Increase interaction with trade partners to match promotions and plans better.

- Monitor promotion success using KPIs like consumer units, incremental ratio, and ROI.

- Employ trade promotion management software to streamline company processes, automate tedious chores, and increase the accuracy of their data and insights.

Our Expertise

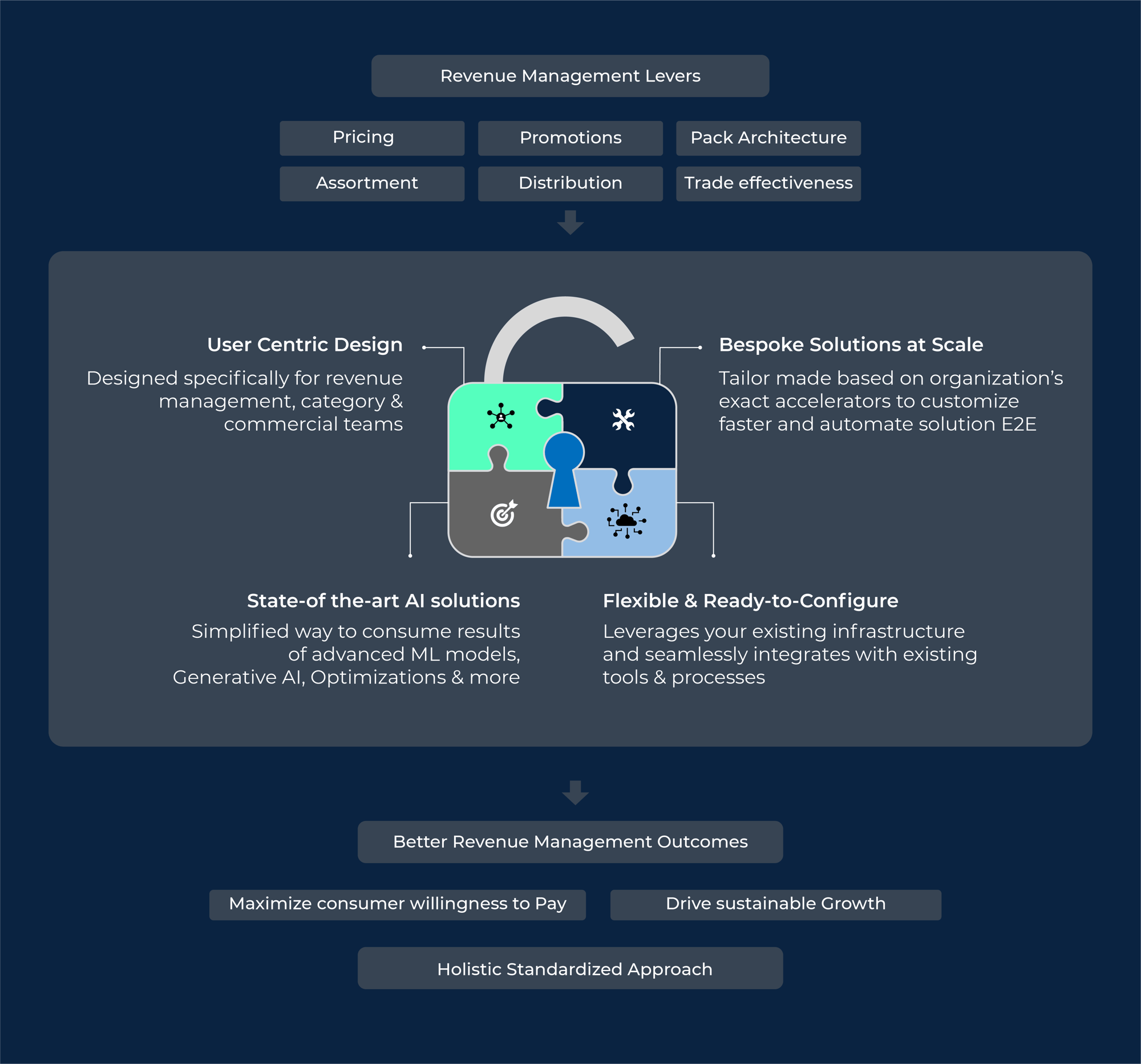

Our pre-built modules on Co.dx for analyzing growth levers of revenue management are based on three principles:

- 42% of consumers say that lower prices drive their purchase decisions.

- 75% of the consumers say they prefer online and offline.

- 46% of the consumers say they shopped a different brand in 2022.